mg Magazine: Unleashing the Mighty Power of Intellectual Property

After Atlanta pharmacist Dr. John Pemberton invented the recipe for Coca-Cola in 1886, sales for the first year totaled about $50. Two years later, an enterprising pharmacist and businessman named Asa Candler bought the formula from Pemberton for $239. Fast-forward to 2023, and Coca-Cola is a Fortune 500 company collecting more than $43 billion in annual revenue. While Coke may be one of the greatest success stories in the history of intellectual property (IP), it surely won’t be the last.

As the cannabis industry continues to mature, companies are investing more resources into protecting the closely guarded trade secrets that will play an increasingly important role going forward. As companies look to get a leg up on rivals, increase their value, and differentiate, unique products, technologies, and assets will be the name of the game.

IP assets are at the core of every other industry, and there is no reason to believe cannabis will be any different. Look at the history of the tobacco, pharmaceuticals, cosmetics, and food-and-beverage sectors. Patents and trademarks have been instrumental in making or breaking fortunes in all of them.

While there have been few patent disputes and trademark challenges in cannabis thus far (partially due to the product’s status as a federally illegal substance), some notable cases will serve as early precedents. Post-federal-legalization, expect a rush to protect the valuable assets that may help companies secure their futures for decades to come.

Staking a claim

The most common types of IP include trademarks, copyrights, and patents. Conduct a search related to a cannabis topic at the United States Patent and Trademark Office (USPTO), and you likely will find hundreds of patents have been granted or are awaiting review.

Companies with valuable IP will become attractive targets for collaborative partnerships and acquisition by larger companies in industries ranging from cannabis to medicine and biotech. Some recent cannabis deals that were driven by IP include:

- In 2021, Jazz Pharmaceuticals bought GW Pharmaceutical for $7.2 billion. GW Pharma is a major international player in cannabis and the maker of Food and Drug Administration-approved cannabis-derived medications including Sativex and Epidiolex.

- In 2021, British American Tobacco bought a nearly 20-percent stake in Canadian licensed producer Organigram for $175 million in an effort to expand beyond BAT’s core business.

- In 2023, Organigram made an $8-million investment in Phylos Bioscience, which develops proprietary genetic identification tools. Organigram is poised to release products incorporating the minor cannabinoid THCV in Canada based on Phylos’s genetics platform.

When the Jazz Pharmaceuticals deal was announced, GW Pharma Chief Executive Officer and co-founder Justin Gover said, “This is an IP estate that is going to continue to build and we think is going to be a strong and compelling one.”

Although there are some limitations on trademarks and patents for cannabis products and cannabis-related inventions, there are numerous ways companies can protect their IP on the state, federal, and international levels.

“It’s supposed to be impossible to get a trademark on an illegal product, but there’s no legality requirement in the patent statute,” said Dale Hunt, founder and senior attorney at Plant & Planet Law Firm in San Diego. “The patent examiners don’t worry about whether something is legal; they just worry about whether it is new and non-obvious and meets the requirements for patentability. So that’s one misconception. People don’t even know patenting is happening and is possible for cannabis-related inventions.”

While federal trademark protection is not available for “unlawful” products such as Schedule I drugs, cannabis companies can plant a flag in other ways. For instance, peripheral products like vape pens and rolling papers are used for legal purposes (tobacco smoking), and manufacturers of these types of products may obtain federal registrations for their branding (company name and logo, product name and logo, et cetera). And because cannabis is legal in many states, companies operating in those states can file state-specific trademark registrations, although those protections are not as robust as a federal registration.

“For most of our clients’ goods, we cannot get registrations on cannabis products, per se, and that has a number of implications,” said Brian Landry, a partner and intellectual-property attorney at Saul Ewing Arnstein & Lehr LLP. “One is that we need to take a variety of different strategies relative to what we use in most other industries to try to obtain protection that includes a large reliance on state trademark registrations, which seldom get much use or attention outside the cannabis industry. There’s also a heavier reliance on common-law trademark rights based on use and commerce, although even that has nuances because there have been some decisions where federal district courts have refused to recognize those common-law trademark rights.”

Device patents

In some cases, the USPTO does grant patent protection for products and processes related to federally illegal goods and services. Three different types of patents are available in the United States: utility patents (processes), design patents (how a product looks), and plant patents (for new or unique plant varieties).

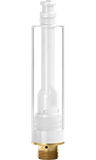

This means companies with unique designs for vape pens, extraction machines, other accessories, or manufacturing equipment may secure patents as long as the inventions are novel and comply with the other requirements of patent law. Cannabis operators may be able to file patents for things like preparation methods, compositions and drug formulations, how compounds engage with human endocannabinoid receptors, and medical-marijuana products and processes.

One of the more significant patent disputes in the industry, adjudicated in April, delivered good news for American vape manufacturers. The U.S. International Trade Commission ruled in favor of U.S. company ACTIVE and a handful of other companies in a year-long patent-infringement investigation initiated by Chinese e-cigarette maker Shenzhen Smoore Technology Limited, which owns e-cigarette patents.

ACTIVE general counsel Doug Fischer explained the case’s significance. “I think what this case demonstrates is companies need to be forward-looking about their IP strategy, and it’s not just their direct competitors that might develop or monetize IP that threatens them,” he said. “It could be companies way across the world, or companies from other industries. You look at pharma and tobacco, and [IP is] an area where they can sort of get a toehold in the cannabis industry without violating any laws.

“There have been some other big IP cases, so I don’t know that I would say this case is necessarily a precedent, because every patent is different and every infringement claim is different,” he added. “But IP is going to be a driving force behind the development of the industry, both plant-touching and ancillary. And businesses that may be only tangentially related because of federal legality can still pursue intellectual property.”

One of the ways a manufacturer can protect a unique product is by registering a design patent that protects the aesthetic appearance of a device. If another company markets or sells a knock-off product with aesthetic similarities to the patented product, the patent holder can sue for damages and to prevent the other company from marketing the similar product. For companies developing new products, it’s wise to undertake a diligent patent search to review existing patents for products that might be similar to the “new” ones on which they are working.

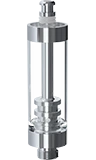

Along with vaping devices, one of the ripest battlegrounds for patents is the extraction sector, where competing technologies and machines are poised to cash in on a lucrative segment of the industry. There are many different ways to extract cannabinoids and other chemicals from the plant using a variety of solvent-assisted and solventless methods.

“There has already been some litigation around extraction,” said Fischer. “And there are some patent-troll companies around. There was a fairly notable case in which GW Pharma was sued by Canopy Growth over a CO2-extraction method. Canopy claimed a patent on the technology, but GW Pharma came out on top.

“I think that’s going to be one of the really hot areas, and I also think you’ll see it in the medical applications of the plant, for various therapeutic uses that can be patented,” he continued. “And then you’ll certainly see it in vaporization and delivery devices akin to what you see in the tobacco world or the pharma world.”

Plant patents

While patents on manufacturing and other types of equipment are fairly straightforward and have a long history of prior art, patenting plant genetics is a much trickier business. Most of the patents filed for cannabis genetics thus far have been for plants that can be asexually reproduced, typically by cloning, so subsequent generations are identical to the original plant.

It’s somewhat ironic that the age-old battle between underground growers over who grows the best weed might soon become a battle in the courts over who has the most enforceable legal patents for their strains. “When people start trying to patent strains, there’s going to be a lot of pushback,” said Landry. “The first thing you’ll hear is, ‘Oh, I’ve had this strain in my family for three generations and there’s no way you can patent it.’ Well, that might be true, but there’s still a lot of opportunity to patent new developments in plant science.”

The Plant Patent Act of 1930 made it possible to patent new varieties of plants that reproduce asexually, although Congress at the time primarily was concerned with plant breeders protecting the intellectual property in fruit trees, nuts, and flowers.

As of the end of June, there were more than 80 patents for cannabis plants, including specific chemovars and the methods to breed them. For growers who believe they’ve developed a unique and marketable cultivar, the best way to protect it is to obtain a plant patent for it, which lasts for twenty years. A potential downside for breeders is that in order to get a plant patent, they must reveal the plant’s genetic makeup, as it must be distinguishable from other plants to be patented.

In addition to plant patents, growers may obtain plant variety protection certificates, which last twenty-five years but require the owner to show evidence the plant is stable and can be reproduced without significant variations. Another option is utility patents, which are useful when breeders create novel and useful applications for cannabis.

In 2020, an Israeli court ruled against a cannabis grower in a patent-infringement case involving the use of unique cannabis strains in a product made by another company. The grower alleged the competing company was growing the exact strain under a different name and said the strain had been developed and patented by him. The court determined the grower had no case because he had neglected to patent the plant in question, and therefore had no legal recourse.

As Landry noted, “The plant industry is very protective of its IP. There is a long history of people pirating their work, and in the fruit, vegetable, and flower industries, these cases go to court quite often. There’s no reason cannabis should be any different.”